#Personal budget items how to

It might take some time, but you can learn how to stick to a budget.

#Personal budget items free

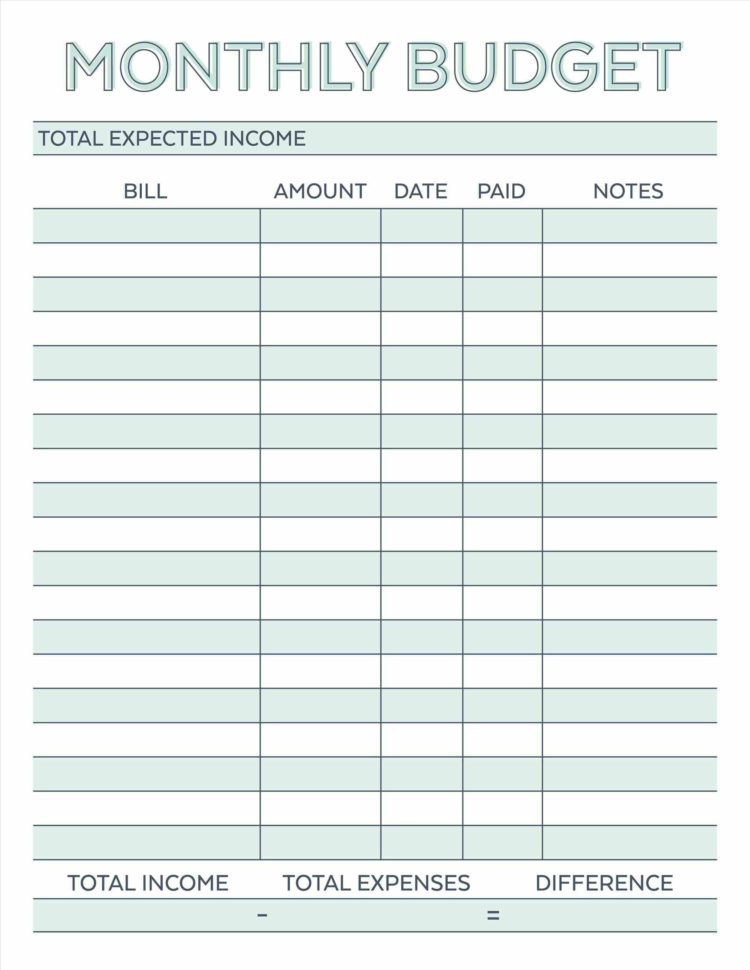

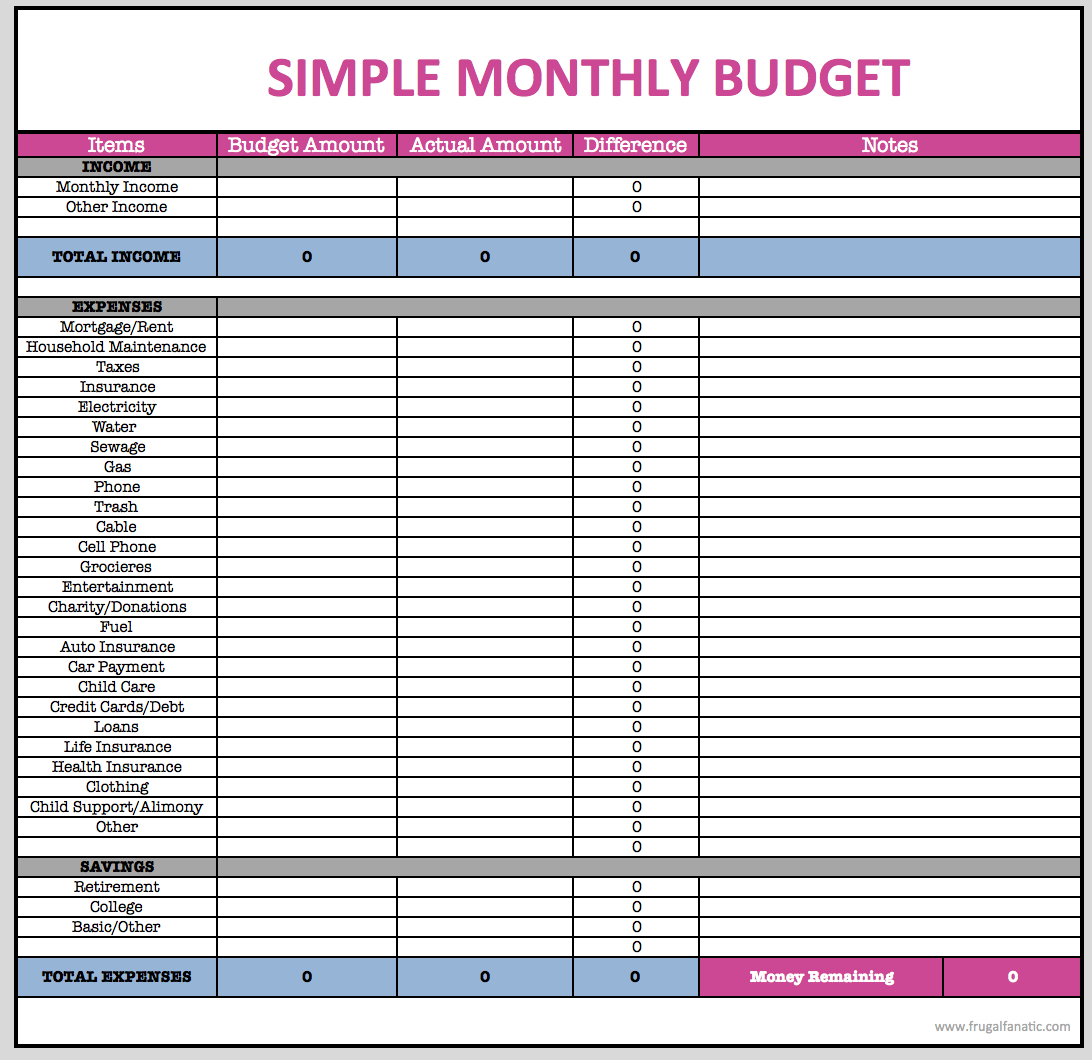

See Also: Best Budget Templates: Free & Paid OptionsĪs I mentioned before, all of us have failed with our budget at one time or another. It is better to aim a little high than to come up short. Remember, for your new monthly budget to work properly, you must account for every single penny you spend and earn. You always want to estimate a little bit high so you’re not scrambling to come up with the money later. When estimating variable expenses, be sure to leave a buffer. Using last month’s bill tends to help you be as accurate as possible. Unfortunately, you’ll need to estimate these expenses on a month-to-month basis or as the need arises. Next, you’ll list variable expenses like: Nevertheless, “fixed” means that they don’t change from month to month.

#Personal budget items tv

Expenses like cable TV and your cell phone bill are optional expenses. It is important to understand that “fixed” expenses aren’t always necessary expenses. Generally, your fixed expenses are those that stay the same each month. Place this section directly below the savings section on your budget worksheet.įirst, break your expenses down into two categories – fixed and variable. Draw a line underneath it and move on to the next category.Īlright, now it’s time to determine your expenses for the month. Add up all the money you made the previous month (or what you will make for the current month), and jot the number down there. So, at the top of your budget, go ahead and create a category for income. This will make it super simple for you to figure out how much money you have to spend. Hot Tip: Create your budget immediately after getting paid. After a few months, you should have enough saved to start paying this month’s bills with last month’s income.

That way, you can equally distribute your bills across your paychecks.Īgain, this isn’t ideal, but it can help you get started. To simplify things even further, contact your utility and service companies and ask if they’ll adjust your billing date. All expenses due between the 16th-31st should come out of the paycheck you receive on the 15th. If needed, adjust your budget so that you’re creating a separate budget for each paycheck.įor instance, all of your bills that are due between the 1st-15th should come out of the paycheck you receive on the 1st. Now, if you’re really strapped, you may need to get a little creative at first – especially if you get paid twice a month. See Also: How to Make a Budget for an Irregular Income Simply use your last paycheck as the basis for that month’s earnings. Don’t pull a number out of thin air either. If you don’t have enough saved to make this happen, don’t panic. It is also going to help you break the cycle of living paycheck to paycheck. This is by far the most accurate way to budget. Rather than estimate your future earnings, try using actual earnings instead!Įventually, you want to get far enough ahead that you can use last month’s income to pay this month’s bills. However, you want your numbers to be as exact as possible.

If you’re like most people, your income varies slightly from month to month. Here is the simple formula you’ll use to balance your new monthly budget:Įasy peasy, right? OK, let’s get started. You are in charge of your money, not the other way around. You are going give each and every dollar a job, tell it where to go, and take control of your financial life. You’re not guessing that you’re gonna save about $200 this month. If you take care of your pennies, you’ll never have to worry about your dollars again! Your income and your expenses should balance to the penny!īudgeting is about details. This is extremely important, so don’t forget: You’ll do this on a monthly basis by giving every single dollar that you earn a specific purpose. The goal of a zero-based budgeting is to ensure that your income and expenses are exactly balanced (“zeroed out”). The system you’re about to learn is called a zero-based budget, sometimes referred to as a zero-sum budget.

0 kommentar(er)

0 kommentar(er)